最後更新: 2025 年 1 月 26 日

2025 年的聯邦所得稅率及各種退休/醫療帳戶存入金額都出來了!包括 401k 及 403b、Traditional IRA、Roth IRA、HSA、FSA。個人報稅的稅率上限普遍增加約2.8%。401k 和 HSA 的存入上限 (2025 Contribution Limits) 有所上調,HSA增長顯著,達到$4,300,FSA上限也有所增加。希望大家能夠充分利用這些帳戶,實現財富自由。。往下看今年可以存入多少,節省多少稅吧!

Table of Contents

2024/2025 聯邦所得稅稅率級距 Federal Income Tax Brackets

個人報稅 Single filers Income Tax Brackets

| 稅率 Income Tax Rate | 2024 | 2025 | 上限增加 | 上限增加比率 |

|---|---|---|---|---|

| 10% | $0 to $11,600 | $0 to $11,925 | $325 | 2.80% |

| 12% | $11,601 to $47,150 | $11,926 to $48,475 | $1,325 | 2.81% |

| 22% | $47,151 to $100,525 | $48,476 to $103,350 | $2,825 | 2.81% |

| 24% | $100,526 to $191,950 | $103,351 to $197,300 | $5,350 | 2.79% |

| 32% | $191,951 to $243,725 | $197,301 to $250,525 | $6,800 | 2.79% |

| 35% | $243,726 to $609,350 | $250,526 to $626,350 | $17,000 | 2.79% |

| 37% | $609,351 or more | $626,351 or more | – | – |

已婚合報及配偶過世 Qualifying Surviving Spouse, Married Filing Jointly (MFJ) Income Tax Brackets

| 稅率 Income Tax Rate | 2024 | 2025 | 上限增加 | 上限增加比率 |

|---|---|---|---|---|

| 10% | $0 to $23,300 | $0 to $23,850 | $550 | 2.36% |

| 12% | $23,301 to $94,300 | $23,851 to $96,950 | $2,650 | 2.81% |

| 22% | $94,301 to $201,050 | $96,951 to $206,700 | $5,650 | 2.81% |

| 24% | $201,051 to $383,900 | $206,701 to $394,600 | $10,700 | 2.79% |

| 32% | $383,901 to $487,450 | $394,601 to $501,050 | $13,600 | 2.79% |

| 35% | $487,451 to $731,200 | $501,051 to $751,600 | $20,400 | 2.79% |

| 37% | $731,201 or more | $751,601 or more | – |

已婚分開報 Married Filing Separately (MFS) Income Tax Brackets

| 稅率 Income Tax Rate | 2024 | 2025 | 上限增加 | 上限增加比率 |

|---|---|---|---|---|

| 10% | $0 to $11,600 | $0 to $11,925 | $325 | 2.80% |

| 12% | $11,601 to $47,150 | $11,926 to $48,475 | $1,325 | 2.81% |

| 22% | $47,151 to $100,525 | $48,476 to $103,350 | $2,825 | 2.81% |

| 24% | $100,526 to $191,950 | $103,351 to $197,300 | $5,350 | 2.79% |

| 32% | $191,951 to $243,725 | $197,301 to $250,525 | $6,800 | 2.79% |

| 35% | $243,726 to $365,600 | $250,526 to $375,800 | $10,200 | 2.79% |

| 37% | $365,601 or more | $375,801 or more | – | – |

- MFS 跟 Single Filer 在前面幾個級距稅率都是一樣的,不過到了 35% 和 37% 就不一樣了喔!

家庭戶主 Heads of Households (HOH) Income Tax Brackets

| 稅率 Income Tax Rate | 2024 | 2025 | 上限增加 | 上限增加比率 |

|---|---|---|---|---|

| 10% | $0 to $16,550 | $0 to $17,000 | $450 | 2.65% |

| 12% | $16,551 to $63,100 | $17,001 to $64,850 | $1,750 | 2.77% |

| 22% | $63,101 to $100,500 | $64,851 to $103,350 | $2,850 | 2.84% |

| 24% | $100,501 to $191,950 | $103,351 to $197,300 | $5,350 | 2.79% |

| 32% | $191,951 to $243,700 | $197,301 to $250,500 | $6,800 | 2.79% |

| 35% | $243,701 to $609,350 | $250,501 to $626,350 | $17,000 | 2.79% |

| 37% | $609,351 or more | $626,351 or more | – | – |

2024 & 2025 基本扣除額 Standard Deduction

| Filing Status | 2024 | 2025 | 增長 | 增長比率 |

|---|---|---|---|---|

| Single filers, Married Filing Separately (MFS) | $14,600 | $15,000 | $400 | 2.74% |

| Qualifying Surviving Spouse, Married Filing Jointly (MFJ) | $29,200 | $30,000 | $800 | 2.74% |

| Heads of Households (HOH) | $21,900 | $22,500 | $600 | 2.74% |

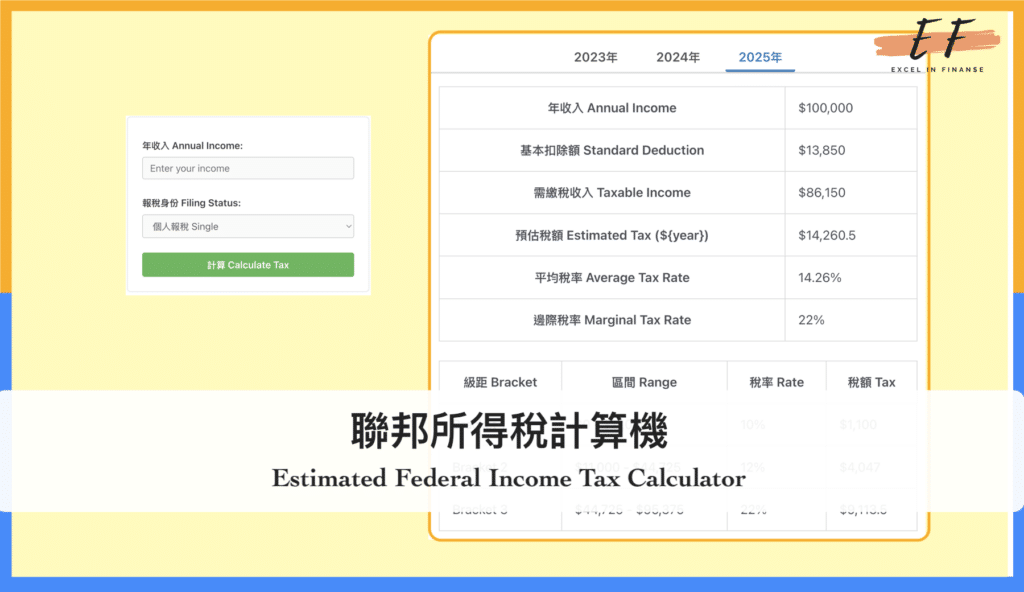

延伸閱讀:聯邦所得稅計算機 Estimated Federal Income Tax Calculator

2024 & 2025 401k, 403b 上限 Contribution Limits

| Filing Status | 2024 | 2025 | 增長 | 增長比率 |

|---|---|---|---|---|

| 僱員存入上限 Employee Contribution Limit | $23,000 | $23,500 | $500 | 2.17% |

| 總存入上限 Total Contribution Limit (顧主+僱員) | $69,000 | $70,000 | $1,000 | 1.45% |

| 50-59 歲及 64 歲以上額外存入上限 Additional Catch-up Limit | $7,500 | $7,500 | $0 | 0% |

| 60-63 歲額外存入上限 Additional Catch-up Limit | – | $11,250 | $11,250 | (New!) |

延伸閱讀:快速認識美國退休帳戶:什麼是 401K 和 IRA

2024 & 2025 IRA 收入限制及上限 Income and Deductibility Limits

Traditional IRA / Roth IRA 存入上限 Contribution Limits

| Filing Status | 2024 | 2025 | 增長 | 增長比率 |

|---|---|---|---|---|

| IRA 存入上限 Contribution Limits | $7,000 | $7,000 | $0 | 0% |

| 50 歲以上額外存入上限 Additional Catch-up Limit | $1,000 | $1,000 | $0 | 0% |

Traditional IRA 收入及抵稅上限 Income and Deductibility Limits

公司有提供其他退休帳戶計劃的福利 Covered by a retirement plan at work

| Filing Status | 2024 | 2025 | 增長 | 增長比率 |

|---|---|---|---|---|

| Single filers, Heads of Households (HOH) | 100% 抵稅: $77,000 (含) 以下 部分抵稅: $77,001 – $87,000 | 100%: $79,000 (含) 以下 Phase out: $79,001 – $89,000 | $2,000 | 2.60% |

| Married Filing Separately (MFS) | Phase out: $10,000 (含) 以下 | Phase out: $10,000 (含) 以下 | $0 | 0% |

| Qualifying Surviving Spouse,, Married Filing Jointly (MFJ) | 100%: $123,000 (含) 以下 Phase out: $123,001 – $143,000 | 100%: $126,000 (含) 以下 Phase out: $126,001 – $146,000 | $3,000 | 2.44% |

公司沒有提供其他退休帳戶計劃的福利 NOT covered by a retirement plan at work

| Filing Status | 2024 | 2025 | 增長 | 增長比率 |

|---|---|---|---|---|

| Single filers, Heads of Households (HOH), Qualifying Surviving Spouse | 沒有收入限制 | 沒有收入限制 | – | – |

| Married Filing Separately (MFS) | Phase out: $10,000 (含) 以下 | Phase out: $10,000 (含) 以下 | $0 | 0% |

| Married Filing Jointly (MFJ) 並且配偶的工作有提供退休計劃 | 100%: $$230,000 (含) 以下 Phase out: $230,001 – $240,000 | 100%: $236,000 (含) 以下 Phase out: $236,001 – $246,000 | $6,000 | 2.61% |

| Married Filing Jointly (MFJ) 並且配偶的工作也沒有提供退休計劃 | 沒有收入限制 | 沒有收入限制 | – | – |

Roth IRA 收入上限 Income Limits

| Filing Status | 2024 | 2025 | 增長 | 增長比率 |

|---|---|---|---|---|

| Single filers, Heads of Households (HOH) | 可存入100%: $146,000 (含) 以下 Phase-out: $146,001 – $161,000 | 可存入100%: $150,000 (含) 以下 Phase out: $150,001 – $165,000 | $4,000 | 2.74% |

| Married Filing Separately (MFS) | Phase out: $10,000 (含) 以下 | Phase out: $10,000 (含) 以下 | $0 | 0% |

| Qualifying Surviving Spouse, Married Filing Jointly (MFJ) | 可存入100%: $230,000 (含) 以下 Phase out: $230,001 – $240,001 | 可存入100%: $236,000(含) 以下 Phase out: $236,001 – $246,000 | $6,000 | 2.61% |

延伸閱讀:快速認識美國退休帳戶:什麼是 401K 和 IRA

2024 & 2025 HSA 上限 Contribution Limits

| Filing Status | 2024 | 2025 | 增長 | 增長比率 |

|---|---|---|---|---|

| 個人 Individual | $4,150 | $4,300 | $150 | 3.61% |

| 家庭 Family | $8,300 | $8,550 | $250 | 3.12% |

| 55歲(含)以上額外存入 Catch-Up (55 and older) | $1,000 | $1,000 | $0 | 0% |

HSA 延伸閱讀:什麼是HSA?美國最省稅的退休投資健康帳戶HSA介紹全攻略

2024 & 2025 FSA 上限 Contribution Limits

| Filing Status | 2024 | 2025 | 增長 | 增長比率 |

|---|---|---|---|---|

| Health Care FSA, Limited Purpose FSA | $3,050 | $3,300 | $250 | 8.20% |

| Dependent Care FSA | $5,000 | $5,000 | $0 | 0% |

FSA 延伸閱讀:什麼是FSA?FSA介紹全攻略,省稅及育兒的好幫手

寫在最後:2024 及 2025 各種 401k/403b/Traditional IRA/Roth IRA/HSA/FSA limits

大部分的額度及限制都增長了大約 2.5%~3% 之間,算是蠻符合美國 2024 年通膨的 2.7%。當然的,體感上是不是只有 2.7% 就不太好說了。蠻可惜的是 2025 年的 IRA 依然還是只有 $7,000 ,沒有任何的漲幅。不過 HSA 和 FSA 都有超過通膨的增長。2025 年也針對 60-63歲的人,推出新的 401K Catch-up limit,美國政府也還是有在做事的!

Derek 做了一個簡易的聯邦所得稅計算機:聯邦所得稅計算機 Estimated Federal Income Tax Calculator,大家有興趣可以玩玩看,試算一下自己 2025 年有多少收入要繳給聯邦政府吧!

希望大家 2025 年可以繼續把各種帳戶存好存滿,早日財富自由!

延伸閱讀:

Sources: